● online

- √ Jual Xenza Gold Original di Aceh Jaya ⭐ What....

- √ Jual Xenza Gold Original di Sulawesi ⭐ Whats....

- √ Jual Xenza Gold Original di Kalimantan Selatan....

- √ Jual Xenza Gold Original di Palembang ⭐ What....

- √ Jual Xenza Gold Original di Tangerang Selatan ....

- √ Jual Xenza Gold Original di Surabaya ⭐ Whats....

- √ Jual Xenza Gold Original di Papua ⭐ WhatsApp....

- √ Jual Xenza Gold Original di Jakarta Timur ⭐ ....

- Gabung Bersama Kami untuk Dapatkan Tambahan Penghasilan Sampai 100 Juta Dalam Program Affiliasi dan Reseller Produk Kami

Will the crypto market always follow bitcoin’s price lead? It may not in the future, this asset manager explains.

[

Hello there! Welcome back to the distributed book, our weekly crypto newsletter, which reaches your inbox every Thursday. I’m Francis U, I’m a cryptocurrency reporter on MarketWatch, and this week I’m going to tell you about the latest and greatest digital assets so far. Contact me on Twitter. @FrancesYue_ Tell us what you think we should send or cover for feedback.

Crypto Instantly

Bitcoin BTCUSD

It is currently trading at around $ 42,900, gaining 1.5% in the last seven days. Ether ETHUSD

It has lost 2.2% in the last seven days and recently traded around $ 3,287. Meme token Dogecoin DOGEUSD

Increased by 6.9% in the last seven days, another dog-like token Shiba Inu SHIBUSD

Showed a 4.5 percent increase.

Crypto Metrics

| The biggest earners | Price | % 7-day return |

|

Oasis Network |

$ 0.51 |

32.9% |

|

Harmony |

$ 0.36 |

26% |

|

Close |

$ 18.4 |

19.3% |

|

Hyphen |

$ 143.6 |

16.2% |

|

Osmosis |

$ 9.3 |

15.5% |

| Source fall-CoinGecko from January 13th |

| The biggest failures | Price | % 7-day return |

|

Olympus |

$ 226.3 |

-28.4% |

|

Wonderful land |

$ 2197.28 |

-13.8% |

|

Loop ring |

$ 1.59 |

-12.5% |

|

Helium |

$ 34.36 |

-11.7% |

|

Celsius Network |

$ 3.28 |

-10.3% |

| Source Fee CoinGeco from January 13th |

Is Crypto different?

Investors’ sentiments about macroeconomics, regulation and the widespread adoption of digital assets are often traded in the same way. However, some industry insiders have suggested that such connections could be weakened by the growing number of cryptocurrencies in various industries.

Jeff Dorman, chief investment officer at Clipto Property Management Arka, told Leder, who shared the interview: According to Dorman, however, such relationships will be short-lived.

Tokens in various sectors posted very different returns over the past year. Bitcoin gained about 25 percent, while ether rose 216 percent. Among other blockchains, Terra LUNA collected more than 10,770%, while Sola and SOLUSD

It made a profit of over 4,000%. XRP XRPUSD

And Cardano ADUSD

160% and 335% returns.

During the same period, the DeFi Pulse index, a capitalization-weighting index that monitors the performance of decentralized financial tokens, gained 42%.

Blockchain Game Token Axie Infinity AXSUSD

And Sandbox rose 16,419% and 13,024%, respectively.

“There is no reason why two properties should have the same characteristics simply because they are packaged in a digital asset package,” Dorman said. “In the same way, why do you expect Healthcare Stock Gold to operate in the way the EFF Primary Technology ETF operates? Not all ETFs are the same.

“It’s the same thing with digital assets. Just because they are packaged in digital assets does not make them the same assets. They have different characteristics. There are different inputs that drive the result,” said Dorman.

Bitcoin interacts with other crypto

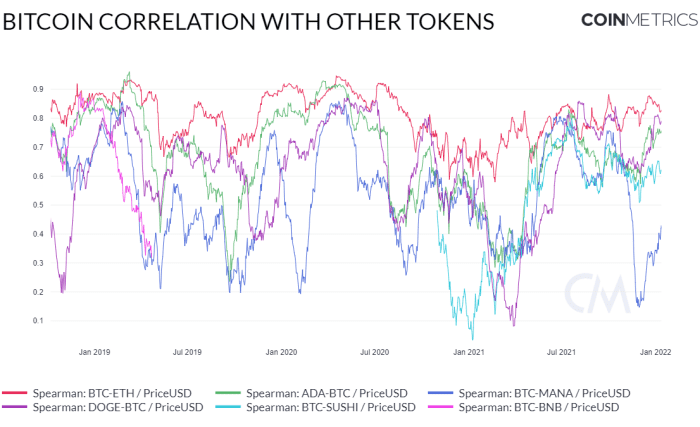

This chart shows the relationship with Smart Contract over the past three years blockchain Ether, proof-of-stake blockchain Cardano, Metaverse-related token Decentraland MANAUSD,

meme token Dogecoin, decentralized exchange token SushiSwap SUSHIUSD

And centralized crypto exchange token Binance coin, respectively.

Although the best version offers Bitcoin trading with different fixed-price indexes, the chart gives some general idea of how Bitcoin traded with other cryptocurrencies.

Match size ranges from -1.00 to 1.00. Positive bonding means that assets have been moving in one direction, while negative relationships are moving in the opposite direction. The bigger the absolute value, the stronger the connection.

Bitcoin has developed positive relationships with most selected crypto over time. Its relevance to ether is high compared to other brands. Bitcoin’s relationship with most cryptocurrencies has seen a sharp rise in recent market sales.

Coin Measures

Citadel’s Potential crypto pressure?

Citadel Securities, an e-commerce maker based in Ken Griffin, announced on Tuesday that $ 1.15 billion from Venture Capital giant Sequoia and Crypto Investment Clothing Parade.

In the comments section, MarketWatch’s Thornton McEnery writes how the Citadel deal will give a big leap for going overseas. “While it is an open secret that Griffin Citadel wants to be the next Goldman Sachs, she is a superpower who can create markets, regulate fair trade and fund substantial agreements,” McEnery wrote.

Paradigm is a venture capital company that focuses on investing in crypto companies and protocols, which could hint at Citadel’s move to crypto.

In the statement“We look forward to collaborating with the Sitadel Security team to expand their technology and expertise to further markets and asset segments,” wrote Matt Huang, co-founder and managing partner of Paradism.

Compared to some of the other major digital businesses, Citadel is a bit late to the crypto game, which may be related to Griffin’s long-term suspicions about digital assets, although the billionaire said his company in October. Trade cryptocurrencies if handled correctly.

Other major frequency trading companies, such as Jumping Trading and Hudson River Trading, have brought a modest approach to the industry and hired Quant Hage Fund Two Sigma. Roles of crypto operations To build a crypto business.

Coinbase exchanges derivatives

Coinbase announced on Wednesday that it is acquiring exchange exchanges Fairx as it offers retail and institutional customers access to crypto exchange, bitcoin and other cryptocurrencies to expand, but reach out to the growing world of related currencies.

After Binance, Coinbase, according to CoinMarketCap, has the second-largest trading volume of cryptocurrencies at around $ 3.3 billion, according to CoinMarketCap.

With its roots in the retail market, Chicago-based FXX, Coinbase, will help its customers gain access to specific crypto futures for sale in the CFTC-controlled platform.

According to Crypto Compre’s website, crypto trading volume stood at $ 2.9 trillion in December, surpassing space trading.

what else?

Changpang Jao, or CZ, founder of the world’s largest crypto exchange Binance, It has a net worth of $ 96 billion.According to Bloomberg Billionaires, Mark Zuckerberg is the best. The resource does not take into account CZ’s private crypto content. Binance argues for the accuracy of Bloomberg’s Zhan net worth estimate, which crypto is “prone to high volatility,” according to a Bloomberg article.

Zao warned investors on Twitter last year that it was important to address their concerns. “I could have lost my house. If Bitcoin goes to 0, I can always get a bank job. My (simple) lifestyle does not hurt much. Not everyone is in the same situation, ”Zhao said He wrote.

In other Crypto-related news, many companies and banks are launching their own stable coins, this type of crypto currency is linked to other assets, often in exchange rates.

It’s Pay Pal Explore to launch your own stable coinCoalitions of banks, including New York Community Bank, NBH Bank, First Bank, Sterling National Bank and Synops Bank, will be launched. Their own stable coin, called the USDF.

Crypto Companies, Funds

Coinbase Global Inc., a cryptocurrency company. COIN shares

It traded up $ 232.75 per cent on Thursday afternoon. Reduced by 0.5% for the last five trading sessions. Michael Silor Micro Micro Strategy Inc.

A 3.4% decline on Thursday to $ 497.34, and a 0.3% loss in the last five days.

Mining Company Riot Blockchain Inc. RIOT

Shares fell 3.2% to $ 20.44, losing 0.2% in the last five days. Marathon Digital Holdings Inc. MARA shares

It is down 6 percent to $ 28.53, and is down 2.7 percent in the last five days. Another miner, Ibang International Holdings Inc. EBON

It dropped 7.1% to $ 0.98, an increase of 5.5% over the last five days.

Overstock.com Inc. OSTK

Tank 2.85% to $ 52.23. Shares fell 2% in five sessions.

Block Inc. ‘ S.K.

s Shares fell 3.7% to $ 144.15, losing 3.12% for the week. Tesla Inc. TSLA‘S.

Shares fell 4% to $ 1,061.5, losing 0.3% over the last five sessions.

PayPal Holdings Inc. PYPL

It lost 1.5% to $ 184.52, and lost 4% over the five-session period. NVIDIA Corp. NVDA

It lost 4% to $ 268.47, and has seen a 4.8% loss in the last five days.

Advanced Micro Devices Inc. AMD

It dropped from 2.7% to $ 134.1 and lost 1.6% in the last five trading days, following Thursday afternoon.

In place of the fund, ProShares Bitcoin Strategy ETF BITO

Was 2.2% Thursday to $ 27.01, while Valkyrie Bitcoin Strategy ETF BTF

It dropped from 2.2% to $ 16.71. VanEck Bitcoin Strategy ETF XBTF

It dropped from 2.5% to $ 42.2.

Gray Balance Bitcoin Trust GBTC

It traded at $ 30.97 with a 3.4% discount on Thursday afternoon.

Must read

Sumber artikel : https://www.marketwatch.com/story/different-crypto-will-be-less-correlated-as-healthcare-stocks-wont-move-in-the-same-way-gold-etf-moves-a-crypto-asset-manager-says-11642101628?mod=cryptocurrencies

Will the crypto market always follow bitcoin’s price lead? It may not in the future, this asset manager explains.

[ JEPARAdigitren.id – Sebanyak 200 tukik atau anak penyu jisis sisik dipsliarkan di Pantai Cemara, Desa Kemujan, Kecamatan KarimunjawaKabupaten JeparaJawa Tengah, Sabtu (12/3/2022). Pelepasan tukik turut dilakukan Bupati Jepara Dian Kristiandi. Saya juga mencoba menghubungi PAUD Desa Kemujan untuk berbagi konten. Sebelumnya, Andi (Spanyol Dian Kristiandi) memainkan penis jenius selama 85 detik di Balai Taman […]

Digitren Indonesia – Cari Milagros ya Gaes? dan sedang menulis kata kunci jual Milagros terdekat di mesin pencari Google. Anda... selengkapnya

Digitren – Pemerintah Thailand telah secara resmi menutup aplikasi baru untuk paket perjalanan Test & Go, dan telah membatasi paket […]

[ Singkirkan bacaan yang populer tentang sela-sela sholat Tarawih digitren.id, – Ketika sholat tarawih, selain sholat juga diselingi dengan sela-selanya. doa dan dzikir. Mengutip buku”Qiyamullail dan Ramadhan” karya Isnan Ansory dapat diunduh atau diunduh dari situs ini atau kapan saja. sholat tarawih sebenarnya tidak memiliki contoh langsung sunnah dari Rasulullah SAW. Baik wirid itu dalam […]

[ Joint Fund memiliki prospek yang kuat untuk peluang investasi start-up untuk tahun 2022. Salah satu reksa dana yang paling […]

Kita bisa bekerja sama untuk mencegah wabah Covand-19. Sejarah telah menunjukkan bahwa vaksin sering menyelamatkan dunia dari pandemi. Vaksin merupakan […]

[ digitren.id, Jakarta – PT Utomocorp selaku agen pemegang merek Italjet di Indonesia, resmi melkancurkan skuter premium Italjet Dragster Limited Edition. Skuter asal Italia ini ternyata sudah dirakit secara lokal di pabrik Utomocorp di kawasan Tangerang. “Italjet Dragster Limited Edition ini sudah kami rakit lokal sejak 2 minggu lalu. Unit Italia CKD (completely knock down),” […]

[ Pengabdian juga meningkatkan tingkat pelayanan. Digitren, Jakarta – Berharga adalah salah satu syarat sahnya Doa Apa yang harus dilakukan […]

Efek Samping Xenza Gold – Apa itu Air Alkali Xenza Gold Original Herballove? Adalah salah satu penemuan yang paling revolusioner... selengkapnya

Digitren – Myanmar Ia berencana untuk menerima wisatawan asing pada awal 2022. Dilaporkan dari CNNRencana pembukaan kembali didasarkan pada tanggapan […]

√ Jual Xenza Gold Original di Batam ⭐ WhatsApp 0813 2757 0786 1. Kecamatan Batam Kota √ Jual Xenza Gold… selengkapnya

*Harga Hubungi CS11 / 100 Powered by Rank Math SEO Keperluan akan Backlink sangatlah penting untuk menaikkan peringkat Website di Google. Apalagi… selengkapnya

Rp 100.000 Rp 150.00067 / 100 Powered by Rank Math SEO MAGAFIT MEMELIHARA FUNGSI PENCERNAAN MAGAFIT merupakan ekstrak herbal alami yang diramu khusus… selengkapnya

Rp 80.000 Rp 90.000√ Jual Xenza Gold Original di Jakarta Utara ⭐ WhatsApp 0813 2757 0786 1. Kecamatan Cilincing √ Jual Xenza Gold… selengkapnya

*Harga Hubungi CS√ Jual Xenza Gold Original di Bandung ⭐ WhatsApp 0813 2757 0786 1. Kecamatan Andir √ Jual Xenza Gold Original… selengkapnya

*Harga Hubungi CS√ Jual Xenza Gold Original di Aceh Selatan ⭐ WhatsApp 0813 2757 0786 1. Kecamatan Bakongan √ Jual Xenza Gold… selengkapnya

*Harga Hubungi CS√ Jual Xenza Gold Original di Desa Kota Kabupaten Cianjur ⭐ WhatsApp 0813 2757 0786 1. Kecamatan Agrabinta √ Jual… selengkapnya

*Harga Hubungi CS57 / 100 Powered by Rank Math SEO MēRA Hexa effect MēRA adalah essence mist multifungsi untuk wajah dengan satu… selengkapnya

Rp 380.000 Rp 450.000√ Jual Xenza Gold Original di Jakarta Timur ⭐ WhatsApp 0813 2757 0786 1. Kecamatan Cakung √ Jual Xenza Gold… selengkapnya

*Harga Hubungi CS√ Jual Xenza Gold Original di Jakarta Pusat ⭐ WhatsApp 0813 2757 0786 1. Kecamatan Cempaka Putih √ Jual Xenza… selengkapnya

*Harga Hubungi CS

Saat ini belum tersedia komentar.